Outsourcing RCM and medical billing to EHR companies is a bad choice for independent practice.

Independent practices are reliable sources when it comes to getting care immediately. PCP providers, ER rooms, and general medical practitioners, it is also common that other specialty providers like OBGYN, Podiatry, and mental health practitioners all have independent practices. But these independent practices have the responsibility of managing the complete practice with the collections they make. It is reasonable that they seek outsourcing options to cut costs and focus on core functions like patient care, improving patient access, and purchasing medical equipment to provide better patient engagement.

Why do independent practices choose EHR companies to outsource?

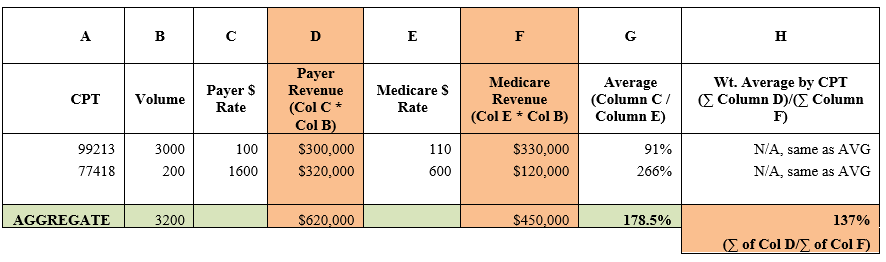

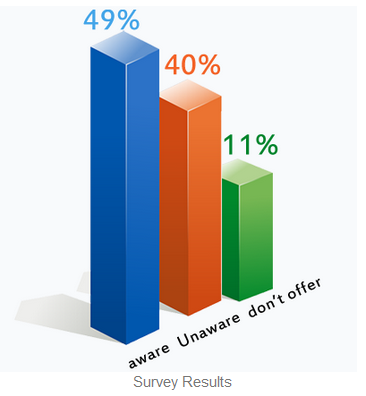

It is a well-known factor that there are plenty of RCM and billing services outsourcing companies. But why do independent practices choose EHR companies to outsource? The reason is simple. EHR companies mostly make their revenue from subscription fees. The reason why they have also included billing and RCM services packages from 2% collections as their fee is that they get reimbursed for a service that they don’t have core expertise on and get paid for it too.

Typically EHR companies target independent practices for this same reason, they get more revenue from these independent practices than they get subscription fees from selling their EHR software to hospitals and health systems. independent are already caught up with their daily clinical and patient care operations they hardly have time to concentrate on the billing and revenue cycle processes.

We have encountered many of our independent practice clients who have similar problem scenarios. They first buy EHR and when the EHR company salesperson states that they provide billing and RCM services at 2% of collections per month, these independent practice managers and doctors seem this to be a good deal and go for it. 6 months down the line they return back to a proper RCM and billing services company like BillingParadise and request to undertake their entire revenue cycle operations because of the following drawbacks when outsourcing RCM services to an EHR company:

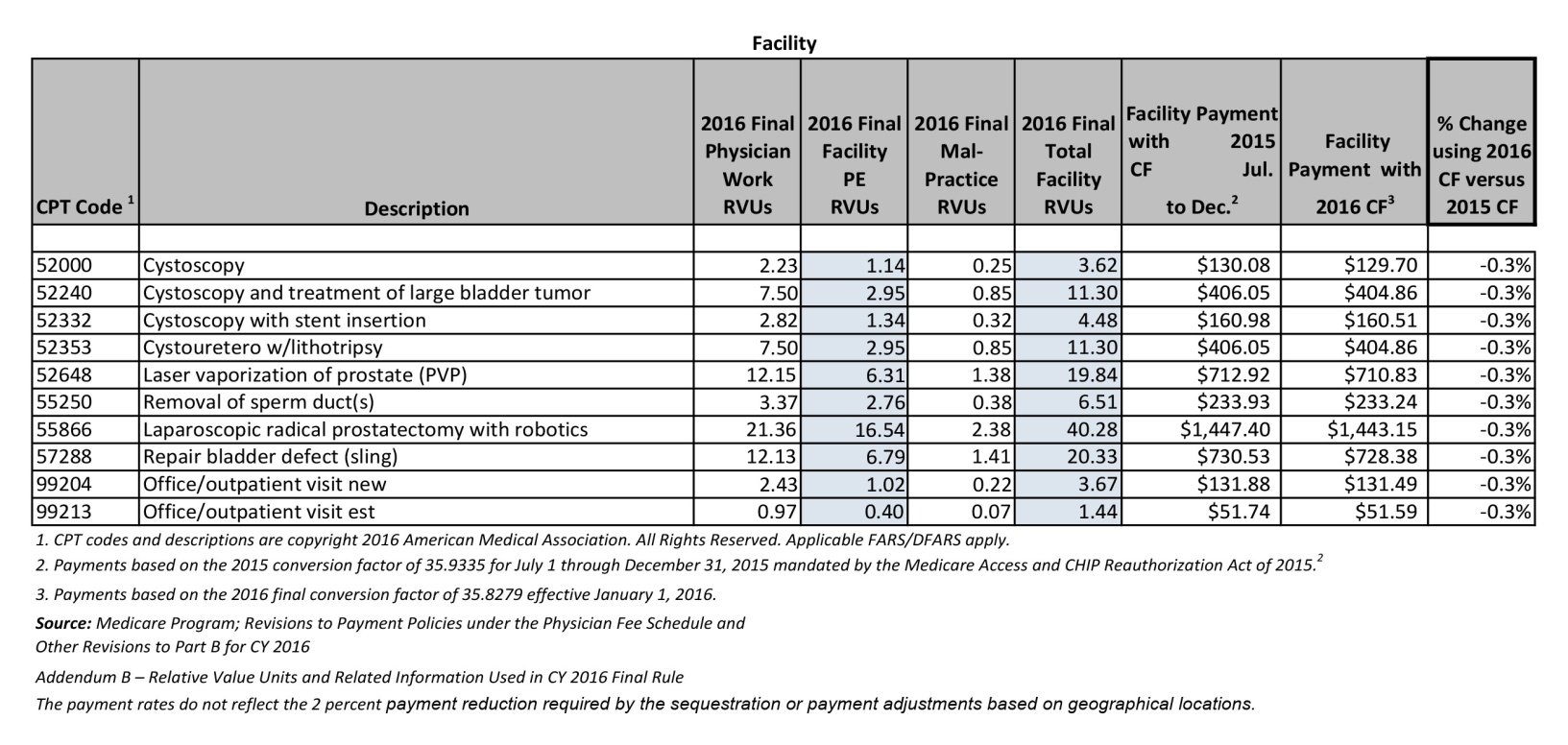

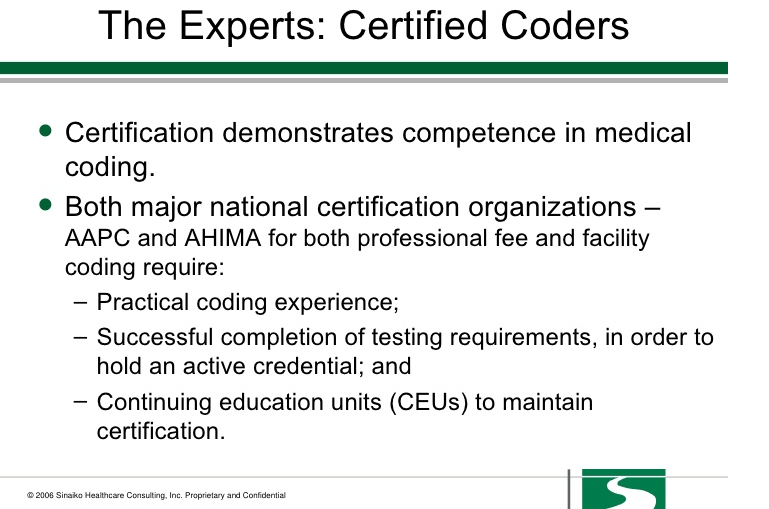

- EHR companies only have technical and customer support for their products and hardly have experienced medical billers or coders.

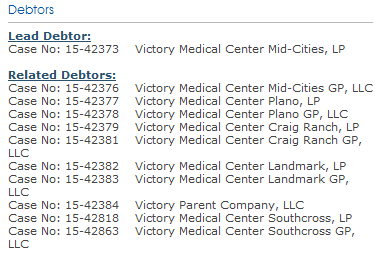

- Because the EHR companies do not have skilled billers or coders they outsource to third-party vendors that do not connect with the practice whatsoever in terms of improving the RCM operations.

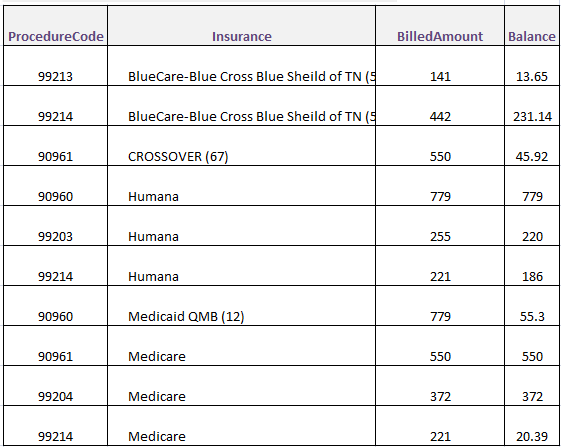

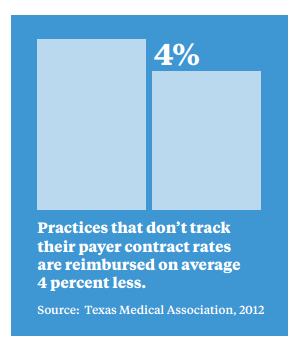

- Billers in EHR companies are only 1 or 2 years experienced newbies that do not understand the concepts of net collections, gross collections, profit margins, etc.

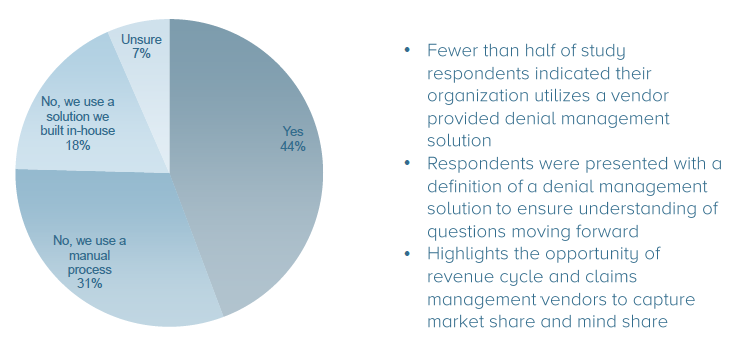

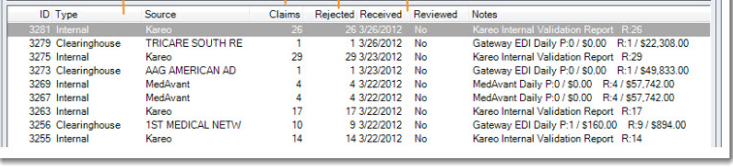

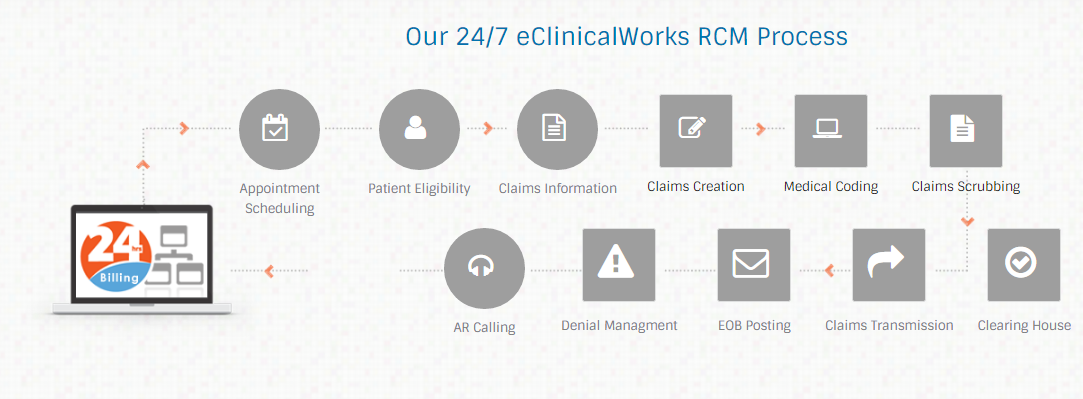

- EHR companies do not work on claim rejections or denials. They assume all claims that pass the clearinghouse are deemed reimbursable.

- They get reimbursed directly and pay the practice after deducting the 2% collections fees.

- 90% of EHR companies’ billing services are just data entry processes after that the RCM processes are incomplete.

- 1 out of every 3 claims that EHR companies code results in an error as they only want to send out claims rather than focus on quality.

- EHR companies do not have a dedicated billing team specifically for your independent practice, they use whichever biller is available at the moment and use them as they have many independent practices that they handle at one go.

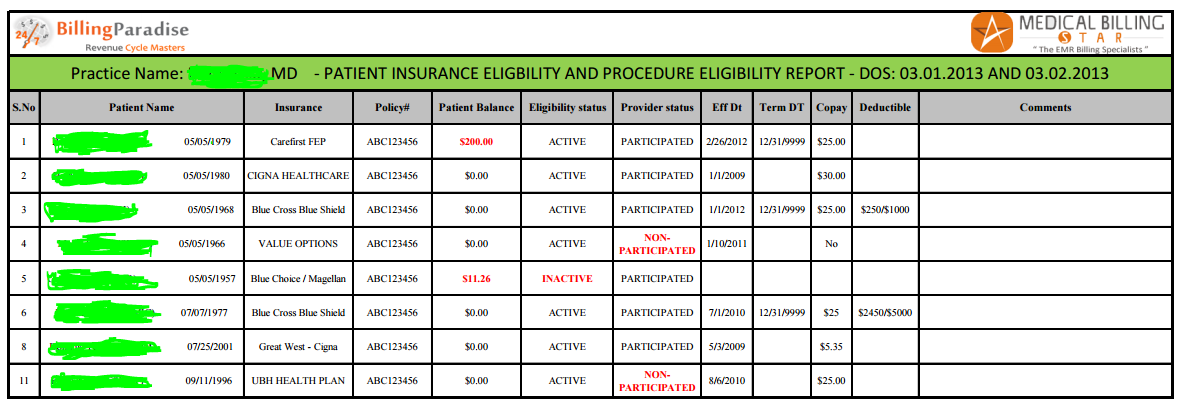

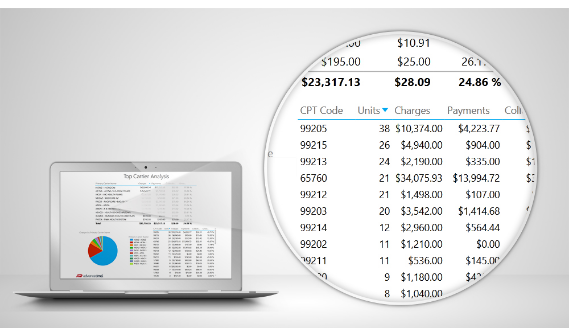

- EHR companies only have access to a few report templates and use them often, unlike direct RCM outsourcing partners they do not dive deep into the practice’s complete RCM processes and performance.

- They do not conduct daily, weekly or monthly reporting sessions to provide insights into the collections and financial growth of the practice.

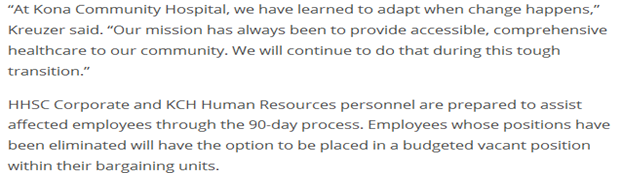

Identifying a correct RCM services partner for an independent practice that provides a dedicated RCM manager, billing supervisor, and certified billing, and coding experts is the correct path to a well-performing independent practice. We advise independent practice managers and providers to first get a consult from BillingParadise’s RCM team and understand the revenue leakages and correct financial performance before continuing the EHR company’s RCM services as data and numbers do not lie and can provide deeper insights on how to grow your independent practice.

Talk to our RCM team through a virtual meeting or set up an onsite appointment where our experts can come visit your practice and provide analytical data in person.